Learn

Looking for more information?

Contact our responsive and friendly client services team any time.

Mining

Last updated 3 years ago

What is the JMEI Program?

Introducing the Junior Minerals Exploration Incentive (JMEI) Program.

INTRODUCTION

The JMEI program was launched in 2018 by the Australian Government as an initiative to encourage and incentivise investment into Greenfields exploration.

It is designed to enable participating companies to transfer tax losses into 'exploration credits' which in turn can be transformed into franking credits or refundable tax offsets for investors.

HOW THE CREDITS WORK

(Please note the below are general explanations)

Every investor who purchases new securities during the JMEI period will receive JMEI credits. This includes shares issued in shareholder offers (Rights, Entitlement, SPPs) and placements. JMEI credits are applied differently to investors depending on their legal entity:

Individual/SMSF - typically a refundable tax offset equal to the credit amount (refundable offsets)

Corporate tax entity - typically can be recognised as franking credits (non refundable offsets) which can be distributed to shareholders

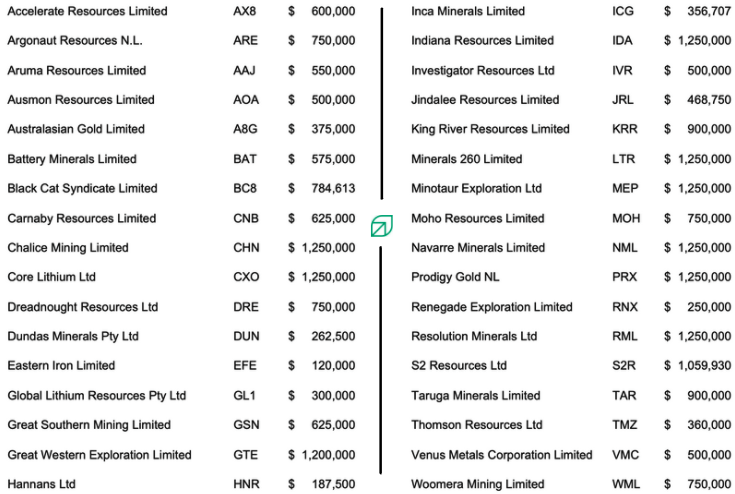

WHICH COMPANIES ARE JMEI PARTICIPANTS

Eligible participants: Greenfield mineral explorers

Greenfield mineral explorers are those intending to raise capital for the purposes of conducting exploration/prospecting activities in Australia. Funds must be directed for those purposes and are allocated on a first come first serve basis by the commissioner up to a total program cap ($25m in FY21/22).

Number of Participants (FY21/22): 34 Companies

WHERE CAN I LEARN MORE OR GET INVOLVED?

For more information be sure to check out our Medium article for a more detailed breakdown of the program and implications for investors in the space - click here.

If you’re interested in being added to our JMEI tracking list (incl. deal notifications) please reach out to our team at deals@freshequities.com.

DISCLAIMER: This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice.

Related readings

Suggested topics

Support

Live Chat

Markets